About Us

wealth strategies

CUSTOMIZED STRATEGIES TO MEET YOUR PERSONAL NEEDS

At The BlackOak Group, we rely on a well-established methodology that incorporates your plan’s most significant components.

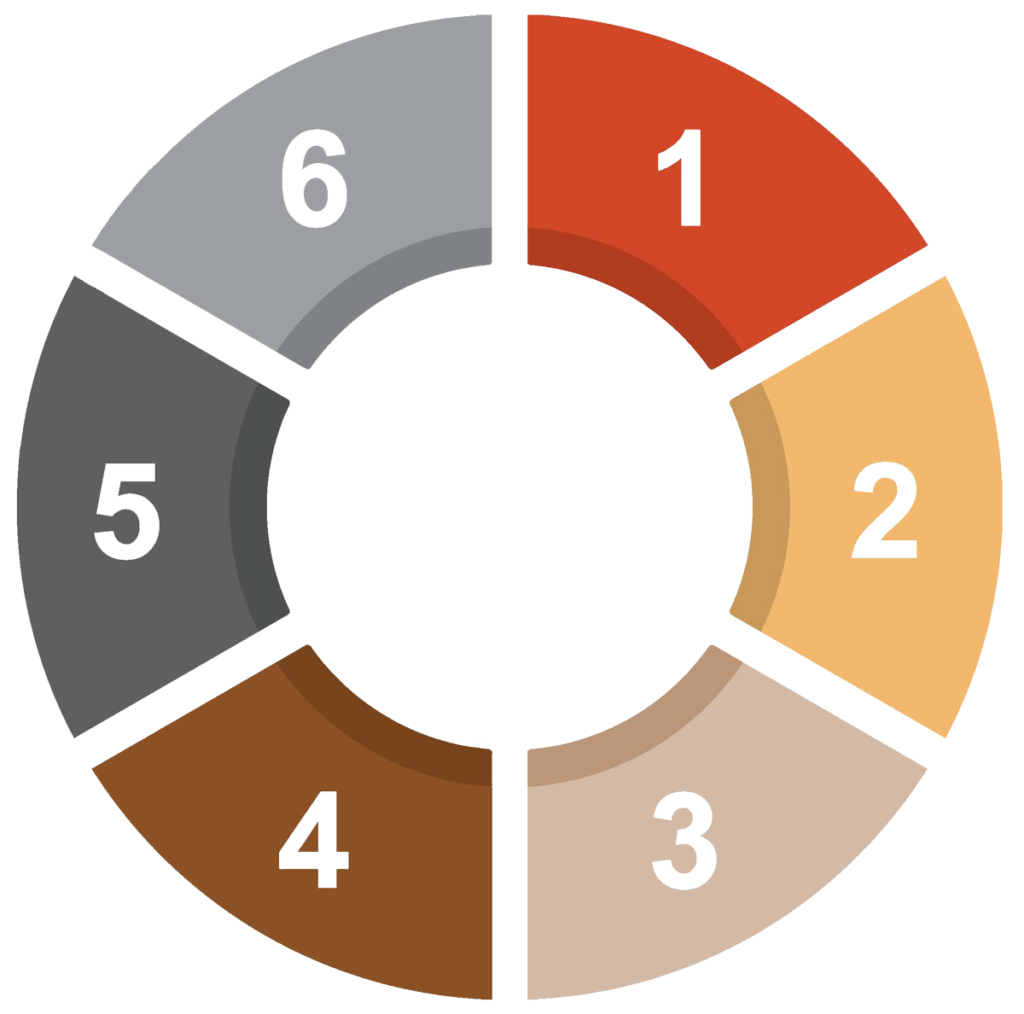

We divided the relative elements into 11 essential parts (6 personal and 5 business) and address them individually, depending on your specific circumstances. We can also recommend investment and insurance strategies to support your chosen goals.

Our approach allows you to evaluate every critical option available. Creating your plan becomes a collaborative effort.

We will help you implement your plan and choose target dates to reassess your original goals.

- 1. Financial Planning

- 2. Retirement Planning

- 3. Education Savings

- 4. Investment Strategies

- 5. Insurance Strategies

- 6. Estate Preservation & Wealth Transfer Strategies

Developing a well-rounded financial plan requires an analysis of all your current financial needs and concerns while still addressing your long-term goals. To construct a meaningful financial plan, we take the time to understand your cash flow and income taxes so you can start on a path toward achieving your personal and financial objectives.

At the heart of most people’s plan is their desire to retire in a comfortable financial manner. Whether someone wants to travel around the world or enjoy time with their family at home, we help our clients build an appropriate savings plan while working and a proper income plan for retirement.

With the increasing costs of obtaining an education, we help clients determine their education priorities and financial objectives for their loved ones. Building out a flexible, efficient savings program to achieve those educational goals is crucial in this process.

Every client has different financial needs, different levels of risk they are willing to take, and different time horizons to achieve their financial goals. We help clients create investment strategies that are customized to their unique situations.

From time to time, life can throw us curve balls. Assessing risk is a crucial part of your plan. If you experience a long-term illness, disability, or premature death, it can adversely impact your family’s financial future. Fortunately, there are a number of insurance products that can reduce the financial loss associated with these risks.

A well-drafted estate plan can ensure that your assets will be used to benefit the people or institutions that you choose in the amount you choose. It attempts to minimize the taxes and costs associated with your death. A good estate plan also keeps the process of settling your estate as simple and efficient as possible.

How we work with individuals and families

We divided the relative elements into 11 essential parts (6 personal and 5 business) and address them individually, depending on your specific circumstances. We can also recommend investment and insurance strategies to support your chosen goals.

Our approach allows you to evaluate every critical option available. Creating your plan becomes a collaborative effort.

We will help you implement your plan and choose target dates to reassess your original goals.

Our mission is to help people build fulfilling futures.

Discover More About Our Holistic Approach