About Us

business strategies

SOPHISTICATED STRATEGIES TO MEET YOUR BUSINESS NEEDS

We understand the challenges of running the day-to-day operations of a business and the financial protection and safeguards needed to help ensure that business owners and their families will be able to maintain their current standard of living.

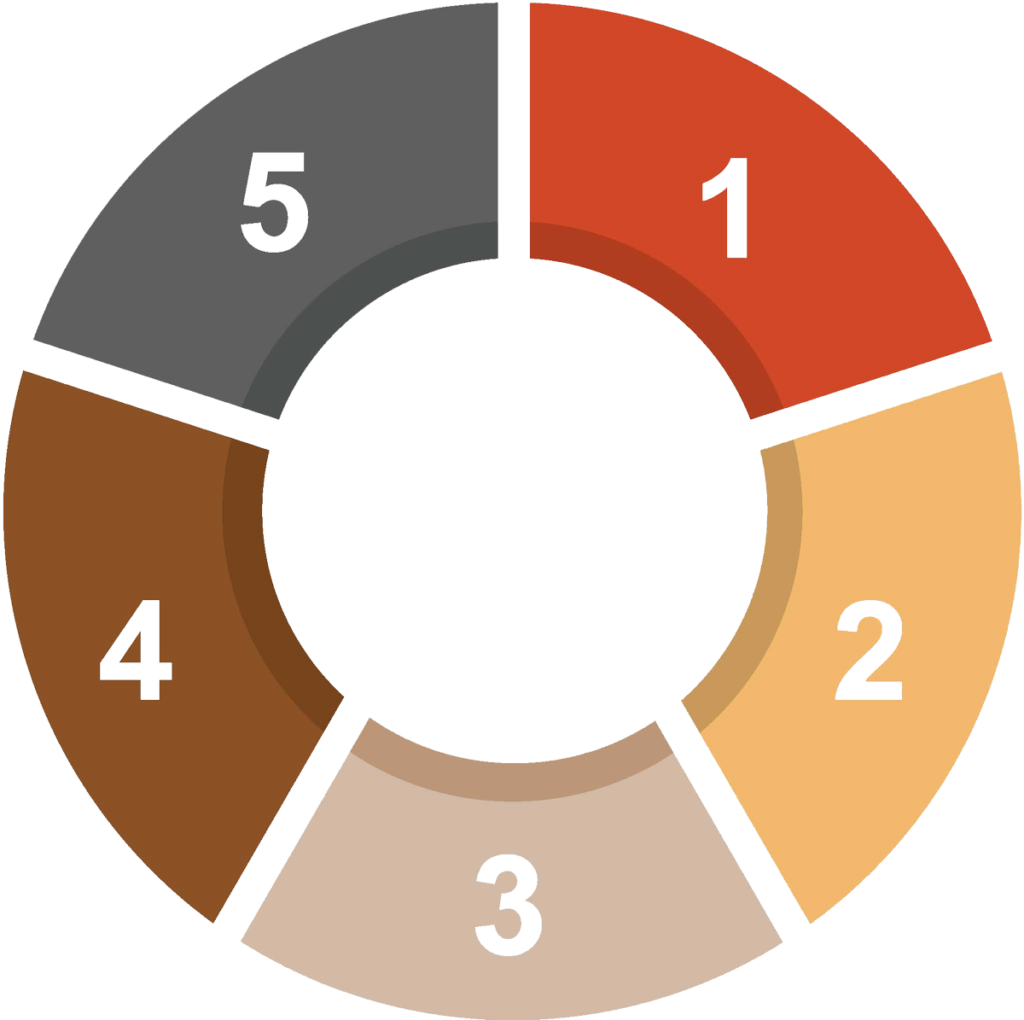

- 1. Employee Benefits Plans, Pension & 401(k) Implementation

- 2. Key Person Planning

- 3. Executive Benefits & Deferred Compensation Plans

- 4. Employee Planning & Seminars

- 5. Business Succession Planning

Key employee retention is often based on providing a competitive benefits package. Many tax benefits are associated with a qualified retirement plan and life insurance program. Benefits packages often aid in recruiting highly trained staff and provide them with additional security that may be unavailable otherwise. We will help you re-evaluate your employee benefits to bensure that all plans providemaximum protection and security.

Every successful business employs key personnel. Have you considered the impact on your business if you unexpectedly lost such a key person due to premature death? In the event of such loss, a well-structured continuity plan can make a difference in the continued success of your business. We can help.

Rewarding and retaining valued employees can be vital to growing and sustaining your business. Executive benefits and deferred compensation plans provide the company with additional tax advantages. We have the experience and financial insight to implement bonuses, cost-sharing, deferred compensation plans, and other non-qualified retirement plans.

Many of our executive-level employees have the same or similar financial planning questions and concerns that you have. We can provide your executives with valuable financial planning information. We believe that helping these employees plan their financial future increases morale and employee productivity while potentially reducing overall costs to your business. In addition, many employees benefit from educational seminars on financial planning, retirement planning, and long-term saving and investing.

Where your business is concerned, you don’t leave success to chance. You shouldn’t leave the business succession to chance either. Whether your business is a one-person operation, a partnership, or a closely held corporation, a business continuation plan should be a component of your overall strategy. What would happen to my business if I (or my co-owner) were to die today? If I died today, would my family’s future plans be met? We can help you develop strategies to address the business continuation and family protection issues raised by these questions – strategies right for your business and right for your family?

Integrated strategies for business owners

A well-structured plan of action can help you control your financial life so that you can feel confident about meeting your goals. Since even the best plans can’t anticipate all the things that can happen in the future, we will meet with you periodically to review your progress toward your goals and adjust your strategy to changing circumstances. Like many business owners, your business and personal financial needs may be closely intertwined.

At The BlackOak Group, our financial professionals work with you to develop and execute an integrated approach designed to help you meet both your personal and business financial objectives.